The greatest improvement would be the fact with this specific choice, you combine your financial and security mortgage toward an individual consolidated mortgage. An earnings-out re-finance will be a simple and easy convenient treatment for fund home improvements, particularly if you was already provided refinancing your property.

Going for a profit-out refinance are a really great option whenever financial rates is reduced. The reason being they makes you re-finance your house during the a lower life expectancy price whilst acquiring loans getting a renovation. Although not, when rates of interest was high, a money-aside refinance can notably improve your monthly mortgage repayment.

Option 3: Recovery Loan

Unlike an equity financing otherwise re-finance, a remodelling loan makes you borrow funds according to research by the value of new enhanced house. For this reason, renovation finance are a good solutions if you have not yet , built up enough guarantee in order to coverage the expense of the new renovations. There are two fundamental types of recovery loans: federal and private.

Federally backed repair fund, including the Sallie Mae HomeStyle Loan, features quicker downpayment conditions, but have a great deal more regulations and you may hoops to diving owing to. Additionally, individual money tend to have high downpayment requirements than simply federal fund, however, give a far more versatile and individualized investment sense.

Step 4: Score Prequalified

Once you have chosen loan to invest in your property improvements, you will then would like to get pre-qualified. Prequalification try a credit imagine that presents lenders just how much capital you could potentially properly secure. They functions as verification your financially able to money the redesign.

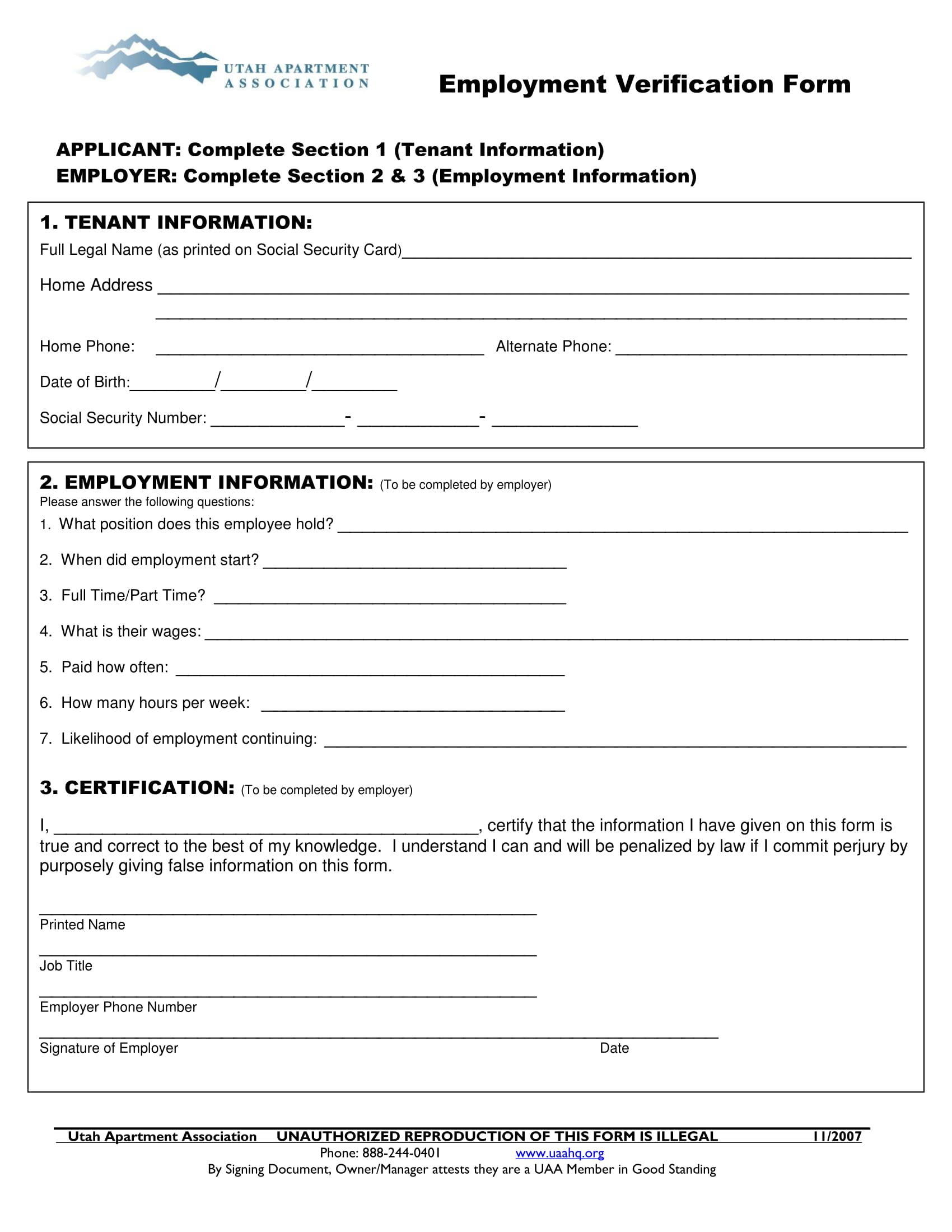

A career History

Bringing detail by detail a job and you will earnings history shows monetary stability and you will fees ability. This allows loan providers to assess the qualifications and see the fresh new lending amount you qualify for.

Normally, you need to bring paystubs during the last at least a couple of years that show a steady money. The lending company can also speak to your employers to ensure the information your give.

Property, Expense, & Costs

The lender will generally speaking ask you to show monetary recommendations, also property, expense, and you may expenditures. Pointers in this way lets lenders an intensive view of your financial state, letting them view your debt-to-earnings proportion and courtroom capacity to deal with mortgage personal debt.

Credit score assessment

A credit check analyzes creditworthiness as a result of evaluating your own percentage background, credit application, and you can credit score. They affects loan conditions and you will interest rates. Due to this fact providing right credit info is critical for taking an informed prequalification conditions you are able to.

Step 5: Framework Your residence Developments

You and your framework cluster will collaborate to develop a-flat out-of structure agreements to suit your repair endeavor. As your patterns capture contour, you’ll get and come up with particular choices into the layout, information, and appear of repair.

All recovery organization covers the design processes a tiny in different ways. Despite and that contractor their get, it https://cashadvancecompass.com/personal-loans-wy/ is necessary that they simply take an active part in common the investment out of exceeding the fresh budget variables dependent prior to now along the way.

In the framework procedure, a beneficial contractor often constantly enhance and track estimated charges for brand new renovations. That way, your work with a reduced amount of a danger of addressing the finish of the design procedure and achieving a last cost one to far is higher than your own approved lending count.

Step six: Undertake Rates

Given that the form plans is actually done, their make party often estimate the full price of the project. If you use a firm such as Lamont Bros. that uses a fixed-pricing contract, possible lock in their price when you signal the latest contract.

This step means you may have an obvious comprehension of the project’s monetary factors you do not come across people unexpected situations otherwise meet or exceed their approved financing amount. In place of contractually guaranteeing your own build can cost you at the start, it could be much harder so you can safe resource.