Homes Loan Balance Import: Rates of interest, Charge, and Charge

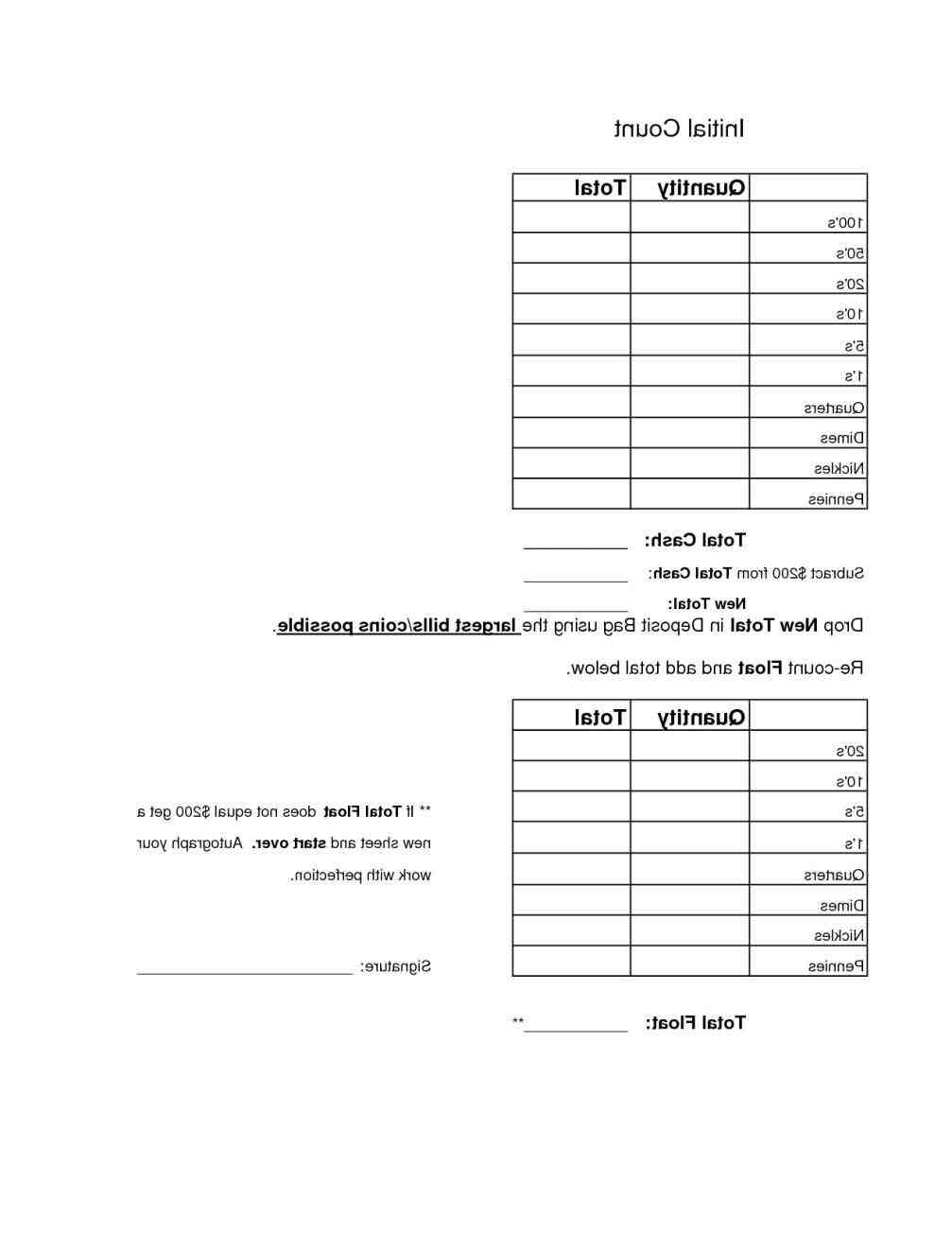

- Go into the PIN password as well as the expected loan amount.

- Mouse click Create OTP’ and you may enter the acquired OTP on particular occupation. After entering the OTP, mouse click Proceed’.

- Populate most of the monetary facts as the asked and you can complete the function. (Note: The latest fields that you need to fill may vary foundation your own a position kind of.)

- Click Submit’ add the application.

The balance Import studio supplied by Bajaj Housing Funds includes numerous positives which make the experience of transferring your Mortgage equilibrium simple and you can hassle-100 % free.

Home loan Interest (Floating)

In today’s economic system, the fresh Set-aside Lender out of India uses the latest Repo Rate as the an effective money market product to achieve numerous fiscal wants into the cost savings. One increase or decrease in the fresh new Repo Price influences the fresh new Roi of all of the economic lending establishments. The current Repo Price are 6.50%*.

Bajaj Housing Money charges a supplementary speed, entitled pass on,’ along the benchmark rate to arrive at the very last credit price. The new pass on may vary on the basis of individuals parameters, including the agency rating, character, locations, and you may approval off competent government, among others.

Prepayment and you can Property foreclosure Charges

Individuals with Home loans associated with drifting rates of interest shell out no more costs on the prepayment or property foreclosure of the construction mortgage count. However, this could changes to possess individual borrowers and you can non-individual borrowers who have financing to own providers objectives. (more…)