Finest Family Guarantee Mortgage Costs: How to Secure the Lowest Costs Today

Securing an informed home security mortgage costs can also be somewhat reduce your interest costs. The current house equity loan cost was 7.7% for an effective ten-12 months name and eight.9% having a fifteen-season term.

By Zachary Romeo, CBCA Assessed by Ramsey Coulter Modified by Venus Zoleta From the Zachary Romeo, CBCA Assessed because of the Ramsey Coulter Modified by Venus Zoleta About Page:

- Latest Home Collateral Mortgage Rates

- Impacting Products

- He Mortgage Costs by the LTV Ratio

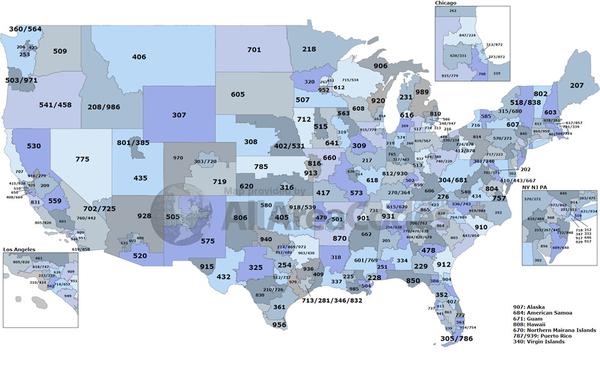

- The guy Mortgage Cost by the Condition

- The guy Mortgage Rates by Financial

- Researching He Loan Pricing

- The way to get an informed The guy Mortgage Cost

- FAQ

House guarantee ‘s the difference between their residence’s market value and you can mortgage balance. Considering Experian, household collateral balances increased because of the 17.6%, showing that more people are utilizing which financing.

An average APRs to have fifteen-season and you may ten-seasons house security funds is 7.9% and you will 7.7%, respectively. Once you understand newest household collateral mortgage cost lets you create informed conclusion which could decrease your borrowing from the bank can cost you otherwise finance significant tactics particularly house home improvements.

Key Takeaways

Prices for fifteen-12 months home guarantee money having an enthusiastic 80% loan-to-really worth (LTV) proportion vary between states. Including, the average Annual percentage rate into the Arkansas is 5.8%, while it’s 8.6% inside the Las vegas.

Lenders in the same state ple, inside Tx, Wichita Falls Coaches Government Borrowing from the bank Commitment also provides 4.8%, while Peak Bank also provides nine.8%.

MoneyGeek checked step one,556 some other banking institutions and you can credit unions using S&P Global’s SNL Depository Rates dataset to remain newest for the current domestic guarantee loan pricing. (more…)