Outlining Virtual assistant Entitlement: Just what You Gained and exactly why It is necessary

Chris was a honor-winning former writer that have fifteen years of expertise from the financial business. A national expert in the Virtual assistant lending and you can writer of The publication into the Virtual assistant Loans, Chris could have been checked regarding Nyc Minutes, the fresh Wall Road Record and more.

Understanding Virtual assistant mortgage entitlement is vital to make by far the most from their hard-acquired benefit. Right here, we fall apart first compared to. extra entitlement and how the entitlement impacts the down payment and you will limit amount borrowed.

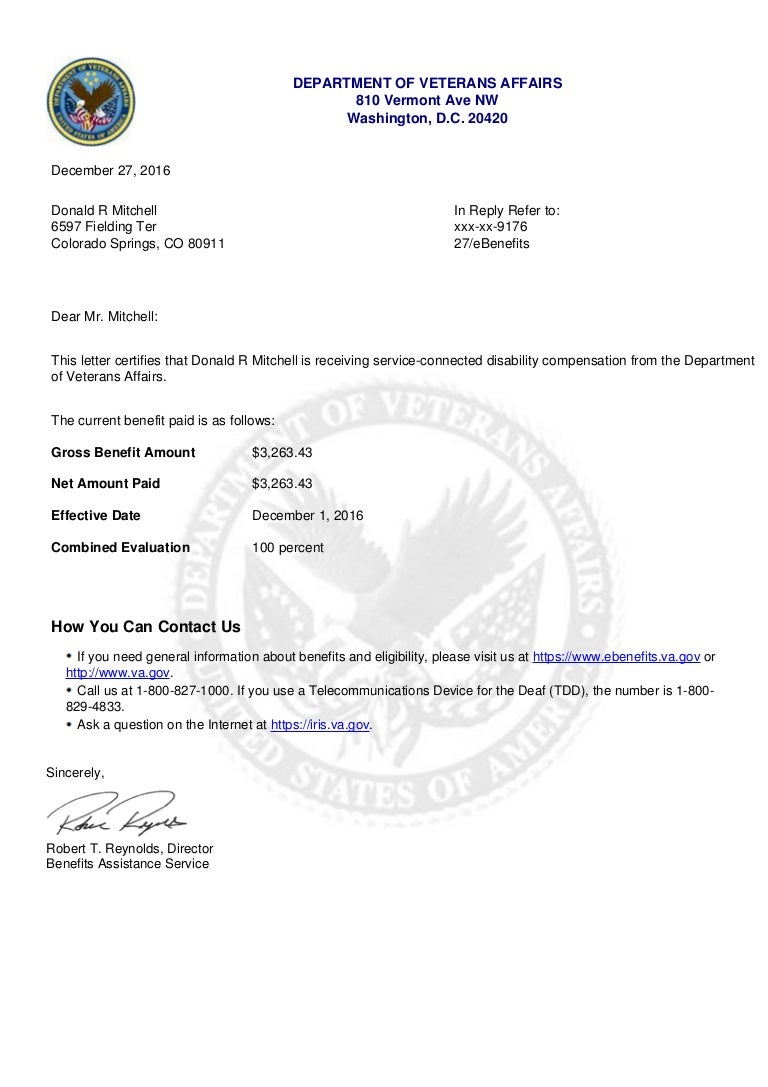

Veterans that eligible for a good Virtual assistant mortgage provides Va financing entitlement, which is essentially a dollar matter the fresh new Va intends to pay-off to a lender just in case you default on the home loan.

You could potentially view it since the something you might be entitled to provided your own solution to the country. That is a painful-acquired and well-deserved work with. But that is not entirely exactly what it form, no less than inside the practical terms.

Va Mortgage Entitlement and you can Maximum Virtual assistant Mortgage Wide variety

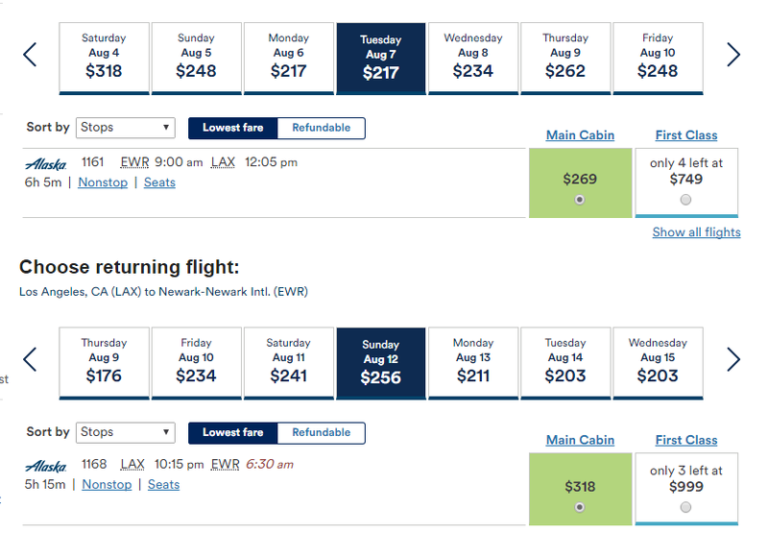

It is very important keep in mind that there’s no restrict amount on the a great Va financing. You can buy up to the lending company was ready to leave you without needing a down-payment, considering you meet the requirements and also have your complete Virtual assistant mortgage entitlement. Some of the nation’s most high-priced elements enjoys mortgage restrictions that exceed the newest compliant mortgage restriction. Imagine elements of Ca, Nyc, Virginia, Hawaii and you may a few most other claims. The fresh Va has high loan restrictions when it comes to those large-costs counties that may assortment as much as $one,209,750. The fresh new Va financing limitations is susceptible to changes from year to year, site this loan limitation calculator observe their 2025 mortgage limitation. (more…)